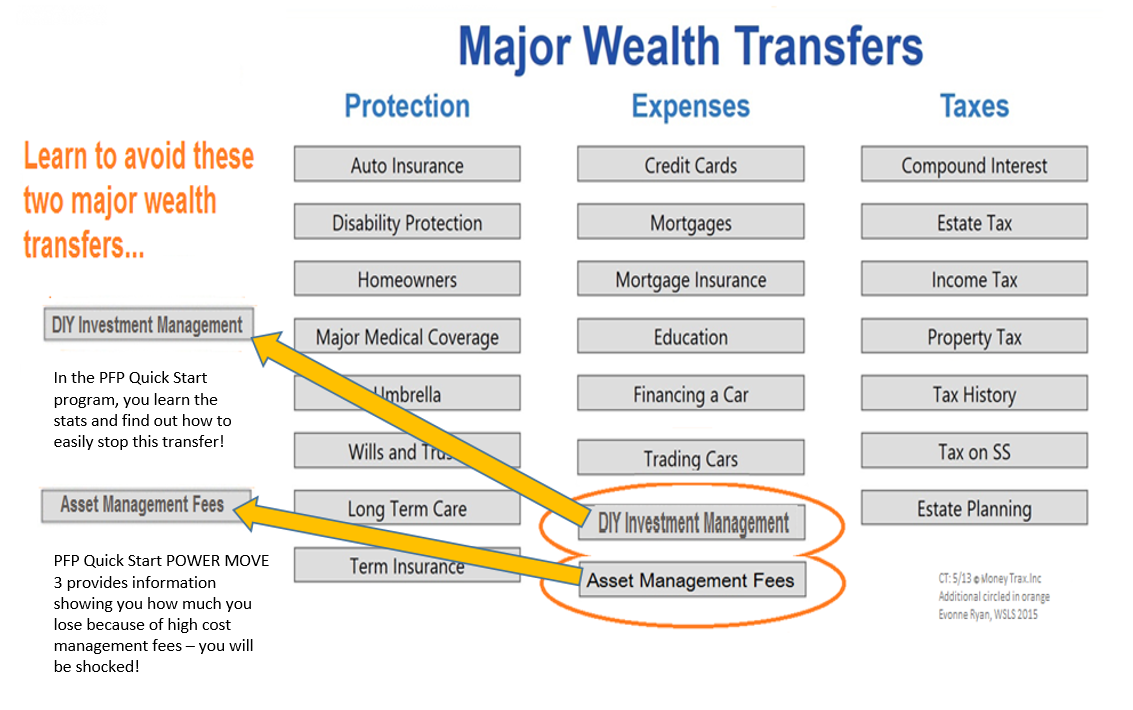

Understand Wealth Transfers

Money you may be transferring away unknowingly and unnecessarily represent losses called “Wealth Transfers”

Are you your own investment manager in your retirement accounts? Many personal investors don’t make good returns on their retirement money with DIY management (Do-It_Yourself)… OR

If you use financial services providers, are high fees costing you thousands (or more) and you are getting less than index results?

WHAT’S THE IMPACT OF DIY MONEY MANAGEMENT AND/OR HIGH-COST ASSET MANAGEMENT FEES?

Knowing your risk tolerance is incredibly important but even more so, it’s important that you reconsider being your own investment manager.

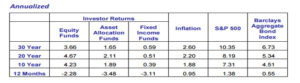

One of the most respected studies on investor behavior and results is the annual Dalbar1 study. Through 12-31-2015, we see that the average investor severely under-performed comparable returns for 1, 10, 20 and 30 years.

Research shows that the majority of people are terrible at determining when to be in or out of the markets. Maybe this dismal performance could be attributed to their own misunderstood risk tolerance. Maybe it’s just their inability to take the time or energy to wisely manage their investments.

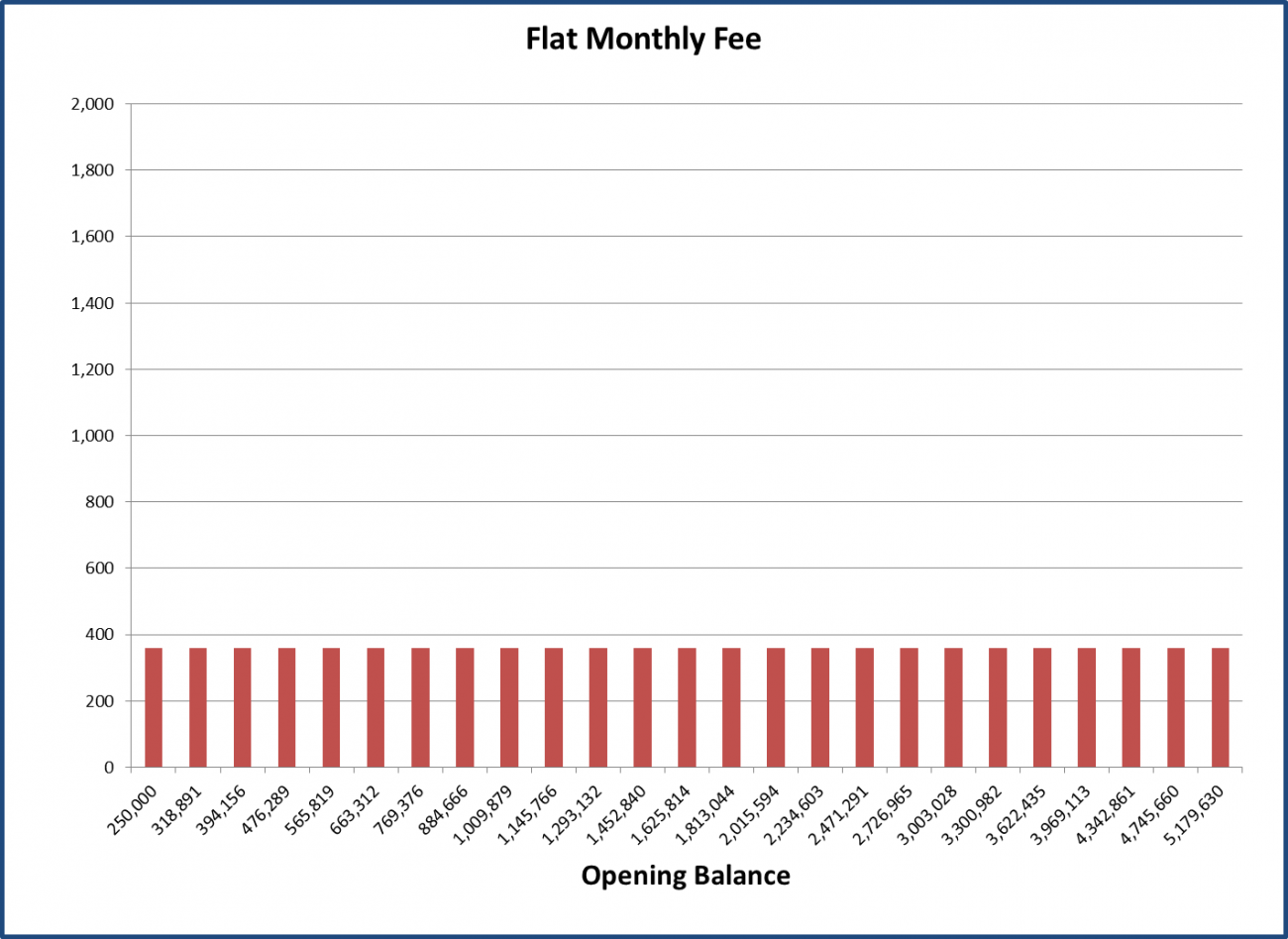

What if investors could choose a money manager that knows your risk tolerance, that knows when to be in or out of the market, always has the time and is ready to choose the best investments? What if the fee for this manager was a fraction of what most places charge OR if you pay a much lower fee because you are a client of ours? Ask us about how we work. You will see that we provide you with an amazingly low cost to help you have great management while you are working with us (a flat and ridiculously low fee no matter the size of your portfolio). Then after 6 months we will discuss if you wish to continue using our management systems OR move to a manage it yourself system or you are free to transfer anywhere else you want.

We totally respect any decision you make and never have judgement. We are just pleased you took the time to become personally empowered by opening up to hearing about strategies and ideas we know will help you.

And as we tell people — we get paid in two ways.

- Yes we do get paid depending on the programs and services we provide. We, however, provide you with a program of empowerment by never asking to have you do something unless you choose to move forward on strategies we have shown you which can make a difference in your life.

- But as rewarding for us is when people say they have told someone about us and ask us to call to set up an appointment for them. When people are ready to find the right financial strategy, they should be talking with professionals who are about helping now seeing them as someone they can sell something to. We pride ourselves on the number of referrals we receive.

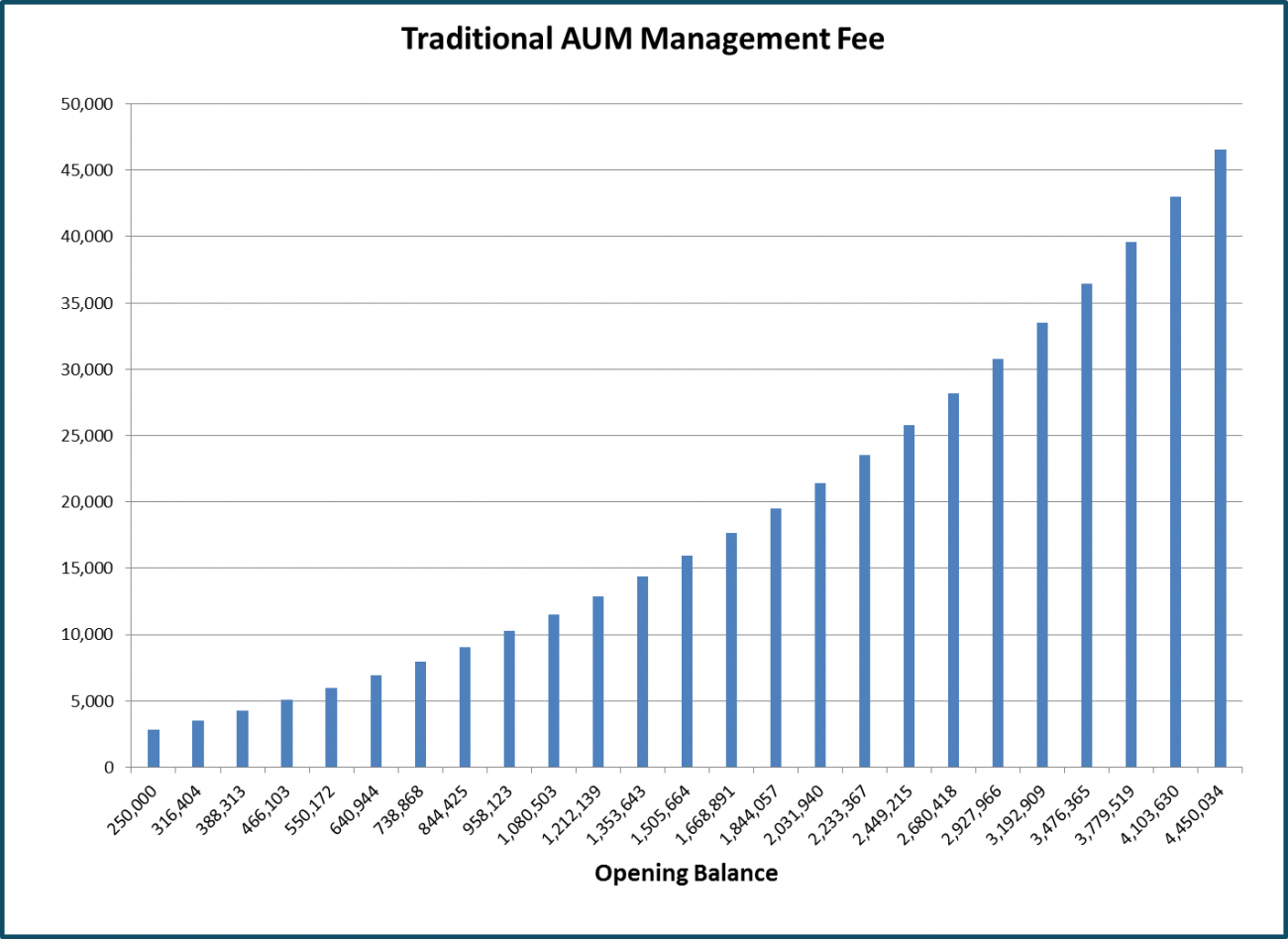

It requires a valuable lesson to choose to have professional help, that you wanted and were willing to buy. However, it does come at a cost. Depending on your arrangement, let’s compare just the management fee’s impact and how much of your hard earned money may be transferring away without your knowledge. We’ll keep everything else the same: rate of return, inflation, investments selected, no distributions and timeframe.

Fees can vary from 0.25% all the way up to 3%, depending on the manager. The example below uses 1%. The traditional AUM management fee” grows as the account grows, even though it likely requires about the same amount of work. “AUM” means assets under management, which grow each year if there are positive annual returns. Sadly, so does the fee.

At the bottom of each graph, notice also how the account size grows each year. On the left, fees are taken out of the account and so less capital for the positive returns to grow. On the right, letting the saved difference compound means the balance grows larger every year.

Which graph would you prefer?

The financial difference between these two graphs is called “opportunity cost”. It’s something you’d probably never miss, but it’s very real.

This type of education is central to the work we do with our clients. It’s critical that you make choices based on your own risk tolerance. It’s also critical that you don’t transfer away any more of your nest egg than necessary through high management fees charged for mediocure returns.