Know What Counts – How do you define WEALTH?

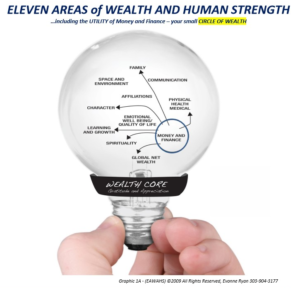

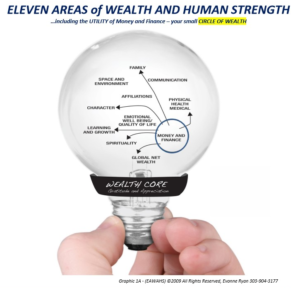

YOUR REAL CIRCLE OF WEALTH – TIME TO OBSERVE DIFFERENTLY

DO YOU KNOW ABOUT EAWAHS!

LEARN ABOUT IT BELOW!!

The time to choose that view is now.

Why might we accept a definition of Wealth that does not serve us? It’s time to reevaluate – understand and appreciate your ELEVEN AREAS OF WEALTH AND HUMAN STRENGTH!

We are bombarded with messages that influence how we judge ourselves, our relationship with what we buy and what we can afford. Sadly, the number of advertising messages we see each and every day is staggering: up from over 3000 in 2007 to an estimated 5000 to 20,000 per day for the average person. There are so many images and messages our brains cannot even process them.

We are bombarded with messages that influence how we judge ourselves, our relationship with what we buy and what we can afford. Sadly, the number of advertising messages we see each and every day is staggering: up from over 3000 in 2007 to an estimated 5000 to 20,000 per day for the average person. There are so many images and messages our brains cannot even process them.

When the definition of WEALTH is been defined by others — especially those interested in selling you products, services and ideas that may serve them more than you or your family, you live with a sense of lack.

It is time to stand back and see the true wealth in your life.

We all feel wealthier when we learn to transform our relationship with money — we start by learning how money works and building our self-confidence.

We encourage you to start by clicking to receive one of our educational papers or sign up for a complimentary webinar. It is the first step and each step leads to another positive step.

What does it mean to have TRUE WEALTH?

What does it mean to have TRUE WEALTH?

How do you feel when you live with a feeling of abundance in your life. If you define wealth by the money you have, the size of your house or the car you drive – you may find yourself constantly looking at what you can’t afford. While money is part of our Circle of Wealth, it is defined differently. Real wealth typically includes what money may never be able to buy.

The key to increasing your wealth is to increase how money serves your real or true wealth. Increasing real wealth can be helped by using money efficiently. This brings additional happiness and satisfaction into your life and the lives of others because it increases the financial resources for serving what’s important.

We know that Personal Financial Power is enhanced when an individual understands how a positive relationship with money helps you determine what real wealth truly is to you. MONEY IS IN YOUR WEALTH CIRCLE BUT IT IS NOT REAL WEALTH. According to Evonne Ryan, the Wealth Strong® Life Solutions founder:

“IT IS TIME TO STEP INTO REALITY AND STOP BELIEVING THAT MONEY DEFINES WEALTH IN LIFE. – Money is meant to SERVE your wealth AS A UTILITY”

Think about this statement. Wouldn’t it be great if your real wealth in life was truly served by the money that comes through your hands and into your life? This is where Certified Financial Coach™ professionals and other educators who work with our clients step in. They help people understand how to make the utility of money become efficient to grow both the money in your life and your true wealth.

After realizing the truth about money’s intended role, we are dedicated to helping you open your mind to observing money so it serves you and your family instead of being a symbol for what you don’t have in life. A positive relationship with money helps you move toward a new way of looking at your financial life. Isn’t this better than being trapped into working to support debt, spending money to keep up pretenses or unknowingly transferring away money to others who know how to make money work more for them, not you? Your money is meant to comfortably support the true wealth in your life.

We know that 59% of Americans fear running out of money — but shouldn’t the bigger fear be living without true wealth in life? Remember Scrooge, who realized much too late that money alone can’t buy happiness? It is a shame to waste a life in this manner.

It is time to observe how we define worth.

Who has the right to judge anyone by the dollars they accumulate? Once you understand and live with gratitude in recognition of the true wealth in your life, you will never again let anyone judge you for any outward material object. Having financial confidence means no one can ever judge your true worth again.

Just notice something a little different. What is the purpose of the money you have?

It comes with understanding money and its relationship to the real wealth in your life. People who are empowered with this knowledge take control and start using money as it’s boss — making money do the job it is intended to do: efficiently serve your life as a utility.

This is called a “wealth transfer.” You’ll learn more about these in the Power section of our website.