Benchmark Your Progress

When you work with us we give you an easy and fun ways to do just that.

It’s important to see the underpinnings of how your plan is designed. It’s also important to make decisions about what’s important and where to go next.

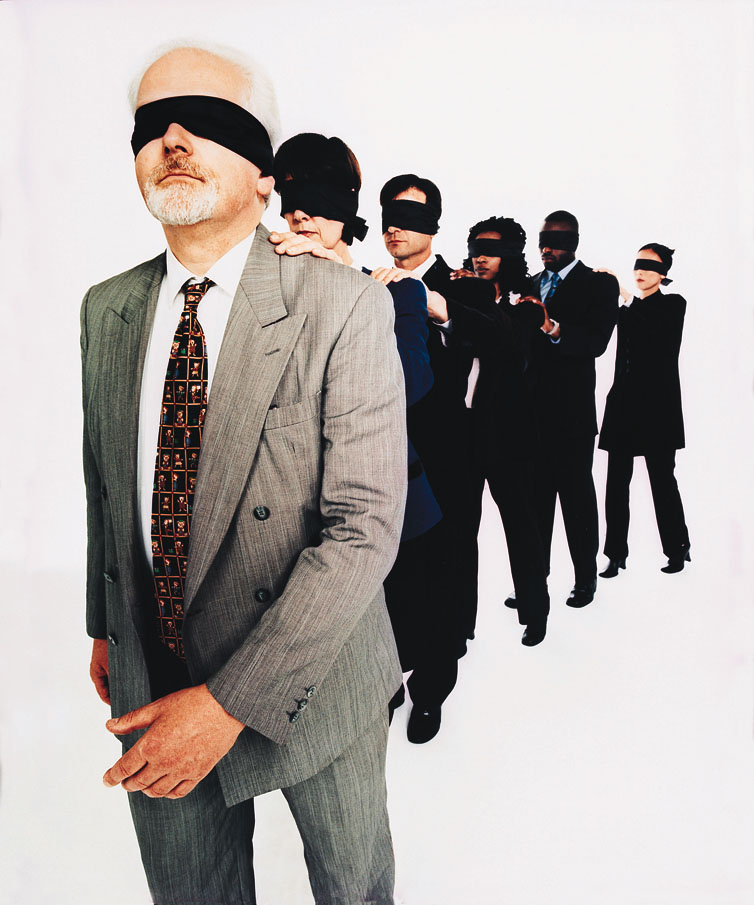

Otherwise you may be following advice of others and then wonder if the advice actually applies to you!

It’s also no fun when you have to drive to someone’s office or hold a conference call just to find out how you’re doing and what you’re doing next.

It’s important to have tools within reach anytime you need them. It is important to have the ability to have your financial information in one very convenient place. Coordinating your financial information in one place simplifies seeing your next move. Accessing your personal data day or night makes you sure-footed. Have what you want: all or any part of your financial picture, in the blink of an eye.

When you think nobody else could have the same challenges with finances you have, we show you how you’re doing and how you compare to people just like you across America.

Some people find it fun!

You get real answers, you get advice and once you know where you are, you are encouraged to continually increase the age to which your current cash flow will continue to have the ability to support your current lifestyle.

We look forward to showing you your own personal situation using the SPENDING GAME

Imagine getting financial clarity with the help of experienced teachers and coaches trained in helping you understand it all.

This program factors in your assets, debt, investments, income, and every other aspect of your financial health. Knowing where you are is the first step to getting where you want to be.

How does it work?

Wealth Strong® Life Solutions (WSLS) helps you start by providing programs through our non-profit programs given by FinER Center (the Financial Education Resource Center) and FedEBC (Federal Employee Benefits Center)

After working through the beginning data gathering and benefit analysis programs associated with each of our non-profit programs, we ask if you wish to continue to work with our team and work directly with WSLS experts. We ask you to keep an open mind – because the strategies we show you may seen uncommon to you. We invite you to bring your other financial professionals to learn if you wish — because the typical financial profession typically is not exposed to the information we have learned over the history of our experts. Also we ask you to be fair. If one of those other financial professionals hasn’t provided you with the time and education we do and you decide to implement some of the strategies, we ask you implement those strategies with us. It is because many people have respected our expertise and realized the typical advice they receive for other professionals may not be as helpful, we are able to spend a portion of what we make to support the non-profit educational providers we support.

WSLS is the sole provider of funding for the two non-profits we sponsor – and we find that enough people need our help and wish to work with our firm because we pride ourselves on our reputation and our ability to give people straight and non-biased information.

The WSLS team is dedicated to helping you learn critical information that may be lacking in your understanding of money and how the world of money really works. WSLS team members are required to sign confidentiality agreements and non-disclosure contracts. Anyone working with you on a one-on-one basis is also required to work in a fiduciary capacity.

Access to your data is provided in one central place – secured by the only cloud based data storage solutions not frowned upon by the SEC. It’s secure because you through a secure portal for your data and also you have the ability to have other personal information stored there without anyone (including the folks at WSLS, FinER Center or FedEBC) having knowledge or access to your personal information.

With all this, our goal to help you gain personal financial power helps you keep an eye on your work with us. And if you wish, you can have added on an aggregator program. Where you can keep your checking accounts, debts, investment information and your expenses in just one place. It is great to have this program at your fingertips and working for you without annoying advertisements bugging you to buy something.

The goal is to have a quick easy way to simplify your financial life –having all information regarding your daily life under one program that is easily accessible, helping you feel confident in your financial tasks.