Knowledge Is Power

It takes a little change:

Spend a small amount of effort using simple programs that increase your financial knowledge, one of the fastest ways to gain Personal Financial Power.

Spend a small amount of effort using simple programs that increase your financial knowledge, one of the fastest ways to gain Personal Financial Power.

Working with WSLS coaches, teachers, staff and advisors provides you a way to achieve personal financial power through a series of steps to make your journey enjoyable and easily attainable.

Our clients are supported through a transformation process, we continually encourage you to see change as part of growth.

Not everyone likes change – but not seeing money through a new observer’s eyes creates a barrier to growth. Fighting change means allowing limiting beliefs to hold you back.

Heraclitus said, “There is nothing permanent but change”. Becoming comfortable with change is one of the most important lessons in life.

Heraclitus said, “There is nothing permanent but change”. Becoming comfortable with change is one of the most important lessons in life.

Knowledge is power. Need more evidence?

Knowledge is power. Need more evidence?

Yesterday’s great thinkers worked hard to gain knowledge. When presented with challenging information, they opened their minds to see how they could integrate the expanded knowledge.

Your ability to expand your own circle of knowledge and take advantage of formerly privileged information is now much larger.

This opportunity is only possible because of technological advances that have occurred over the last decade.

Ten years ago, the PFP program was not even possible. Learning this information required that you go out of your way to discover what was available, pay high conference attendance fees and then travel to sessions where worthwhile information was provided. (According to our January 2014 survey, 87% of American adults use the internet, up from 14% in 1995.) The technological revolution has changed that. You now have the privilege of taking advantages history has never given us.

Let’s face it, you didn’t get to where you are without gaining knowledge during your journey.

So, congratulations on your good work. You did the best you could given the information you received in the past. Now the question is, how do today’s opportunities enhance your current Circle of Wealth? learn more . . .

Start with where you are…

Start with a short exercise in being a new observer. Examine for yourself how things have been working. As us to show you how we start by showing you four boxes of evidence – an exercise to help you strengthen your understanding of how you can choose your own financial direction.

Is it time to beef up your knowledge and gain financial muscle by expanding the circle of knowledge you live in? We work to make it fun and easy!

How has the knowledge you hold onto and your understanding about how it works served you in your relationship with money?

How well is money really serving you?

Stand back for a moment and observe.

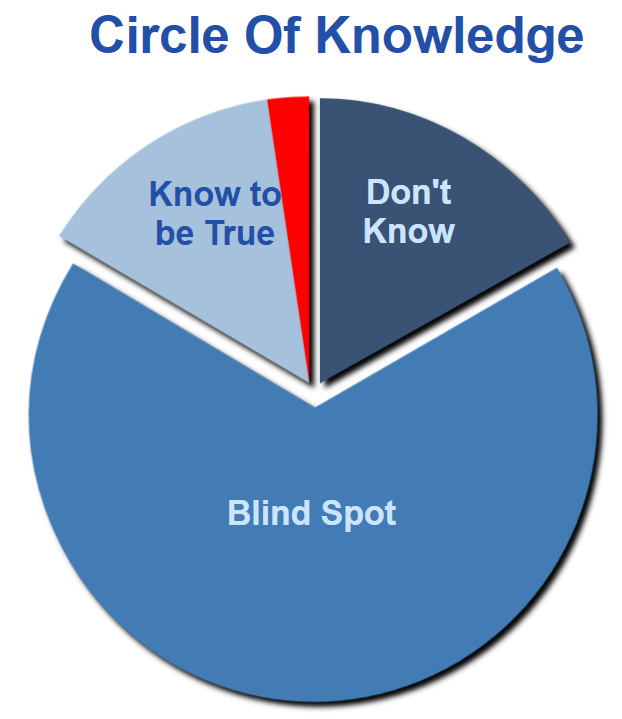

Your “Circle of Knowledge” is split into several areas, including:

- Things you know to be true

- Things that you don’t know. You know that you don’t know them

- Your Blind Spot. Things that you don’t know, and you don’t know that you don’t know.

We provide you what you need to make the difference in your life you always dreamed of. You move from fear about your financial future to having confidence you are capable of making good decisions and doing the best for your family with the money you have.

We help those who wish to build Personal Financial Power the ability to expand their CIRCLE OF KNOWLEDGE so they can make their own great decisions – armed with knowledge, you take control.

We help you expand your current Circle of knowledge with tools and information we provide.

While providing you information that may be totally new or totally out of your wheelhouse, we understand one big thing. There is emotion around the beliefs we have around money. Just ask Evonne Ryan, founder of Finer Center. As a lifetime educator who also has spent over 27 years in the financial industry she discusses the effect of the SIX TIME RULE. She tells us that when anyone hears something completely foreign to their thinking nine times out of 10 they immediately reject it.

It is why taking small concrete step helps you open your eyes to what you may not know while also addressing your relationship with money through programs and services which are non-threatening and free from pressure to make change. If information you don’t understand hits you the wrong way, we know that it is normal.

Our job to help show you what might be in your Blind Spot so you can either calmly take in information in a way that encourages you to evaluate what it all means on your own. If you see that what you didn’t know you didn’t know helps you helps you avoid negative consequences or see ways to take advantage of positive strategies, that is great. We pride ourselves in providing you with a unique understanding of the current ways money is or isn’t serving you and the options that may be available.

Our job to help show you what might be in your Blind Spot so you can either calmly take in information in a way that encourages you to evaluate what it all means on your own. If you see that what you didn’t know you didn’t know helps you helps you avoid negative consequences or see ways to take advantage of positive strategies, that is great. We pride ourselves in providing you with a unique understanding of the current ways money is or isn’t serving you and the options that may be available.

One more thing: do you see the red slice inside the “Know to be True” wedge? It’s too small for text, but it also shows us something we don’t see. What if there were things that we thought to be true, but actually turned out not to be true?

The time for financial confusion is over. Technology allows you to expand your financial power and knowledge in ways never possible before. It is time to get out of the box you may be in. The question is .

In a country where the middle class is shrinking at an alarming rate(1) and over $161,000 is owed per taxpayer for the US National debt, isn’t it time to join the revolution and expand your PERSONAL FINANCIAL POWER?

http://www.pewsocialtrends.org/2016/05/11/americas-shrinking-middle-class-a-close-look-at-changes-within-metropolitan-areas/

-

After more than four decades of serving as the nation’s economic majority, the American middle class is now matched in number by those in the economic tiers above and below it. In early 2015, 120.8 million adults were in middle-income households, compared with 121.3 million in lower- and upper-income households combined, a demographic shift that could signal a tipping point, according to a new Pew Research Center analysis of government data.

-

US Treasury